Let’s talk about a vending machine.

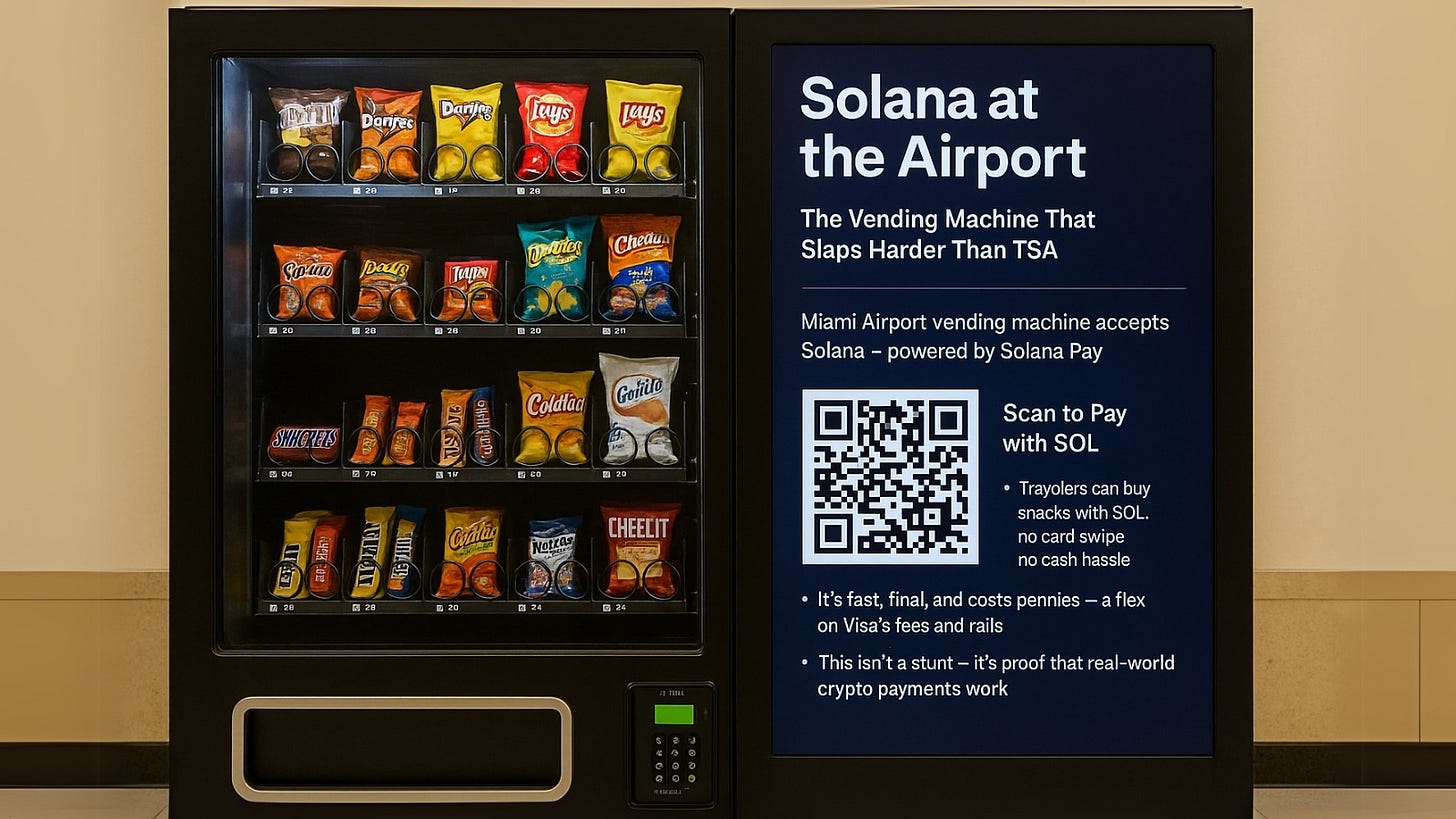

Not just any vending machine — one tucked into the terminal at Miami International Airport that accepts Solana Pay. You walk up, pick your poison (Snickers, Skittles, whatever gets you through TSA), and pay with SOL. Native, instant, and final. No cards. No banks. No middlemen. Just vibes.

To the untrained eye, it’s a novelty. A gimmick. But under the hood? It’s a seismic shift. Because that machine is doing something Visa, MasterCard, and the entire 20th-century financial stack can’t:

settling payments instantly, globally, and for fractions of a penny.

This isn’t about snacks.

This is about rails.

The Real Flex Isn’t the Candy — It’s the Infrastructure

Solana Pay plugs directly into existing point-of-sale systems with no need for third-party processors. No swipe fees. No pending charges. It’s peer-to-peer commerce with zero friction. Your wallet talks to the machine’s wallet — one transaction, one block, and it's done.

You could be from Japan. Or Brazil. Or Kazakhstan. Doesn’t matter. As long as you’ve got a Solana wallet, you're good to go.

This is financial globalization — not powered by banks, but by bytes.

And while TradFi takes 2–5 business days to do anything, this vending machine laughs in finality. You get your chips. The owner gets their funds. No clearinghouse. No ACH. No need to pray to the gods of Stripe or Square.

Miami Isn’t an Outlier. It’s a Canary.

Right now, this machine is rare. But so were QR codes before the pandemic. So were mobile check deposits. So was email. Adoption always looks weird until it doesn’t.

Solana Pay is already live across other IRL integrations — restaurants, pop-up merch stands, and even coffee carts. The tech is ready. The question is: are we?

The Miami install isn’t the endgame. It’s the beginning of something weirder, faster, better. A world where your wallet is your identity, your bank, your storefront. And where that little vending machine is the first real crack in the wall.

Why This Matters More Than You Think

Look past the novelty. This isn’t just "crypto in the wild" — it’s crypto going feral.

The vending machine doesn’t care about your KYC. Doesn’t care about your zip code. Doesn’t need to know if your Chase account is frozen or your Amex got flagged buying gas in Ohio.

It only needs one thing:

Proof that you’ve got SOL.

And that flips the script. Because when a snack machine has better settlement infrastructure than a multinational bank, we’re no longer talking about possibilities. We’re talking about inevitabilities.

You can still laugh at crypto. Just don’t blink.

These systems aren’t trying to replace TradFi overnight. They’re just doing what the legacy stack can’t. Quietly, efficiently, and one bag of Chex Mix at a time.

So next time someone says crypto is just speculation, ask them how long it takes their bank to settle a $3 transaction — then show them the vending machine at Gate D.

The future doesn’t need permission.

It needs adoption.

And a little hunger helps.

—

Stay interesting, my friends.

beatbroker.substack.com