Crypto Giants Clash as FTX Plans $1.2B Payout and Bitcoin Eyes $180K Peak

From Supreme Court's TikTok Showdown to Sony's Blockchain Revolution - The Future of Digital Finance Unfolds

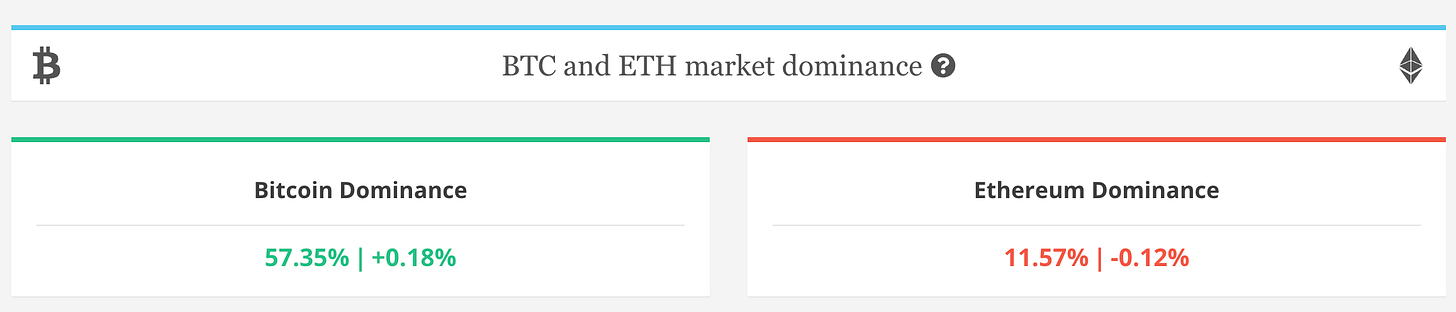

Bitcoin has rebounded over $7,000 after dropping below $90,000 for the first time in months, now trading near $97,000 with a market cap exceeding $1.91 trillion. Altcoins also show recovery, with ETH reclaiming $3,250 and DOGE rising 7%. The crypto market added $200 billion, reaching a total capitalization of $3.5 trillion. JPMorgan projects significant investments if Solana and XRP ETFs are approved, potentially attracting $3–8 billion each. Tether announced plans to relocate its headquarters to El Salvador, citing favorable regulations. Meanwhile, Senator Elizabeth Warren is an idiot.

SUMMARY

XRP breaks critical BTC resistance, analysts project $4-8 range

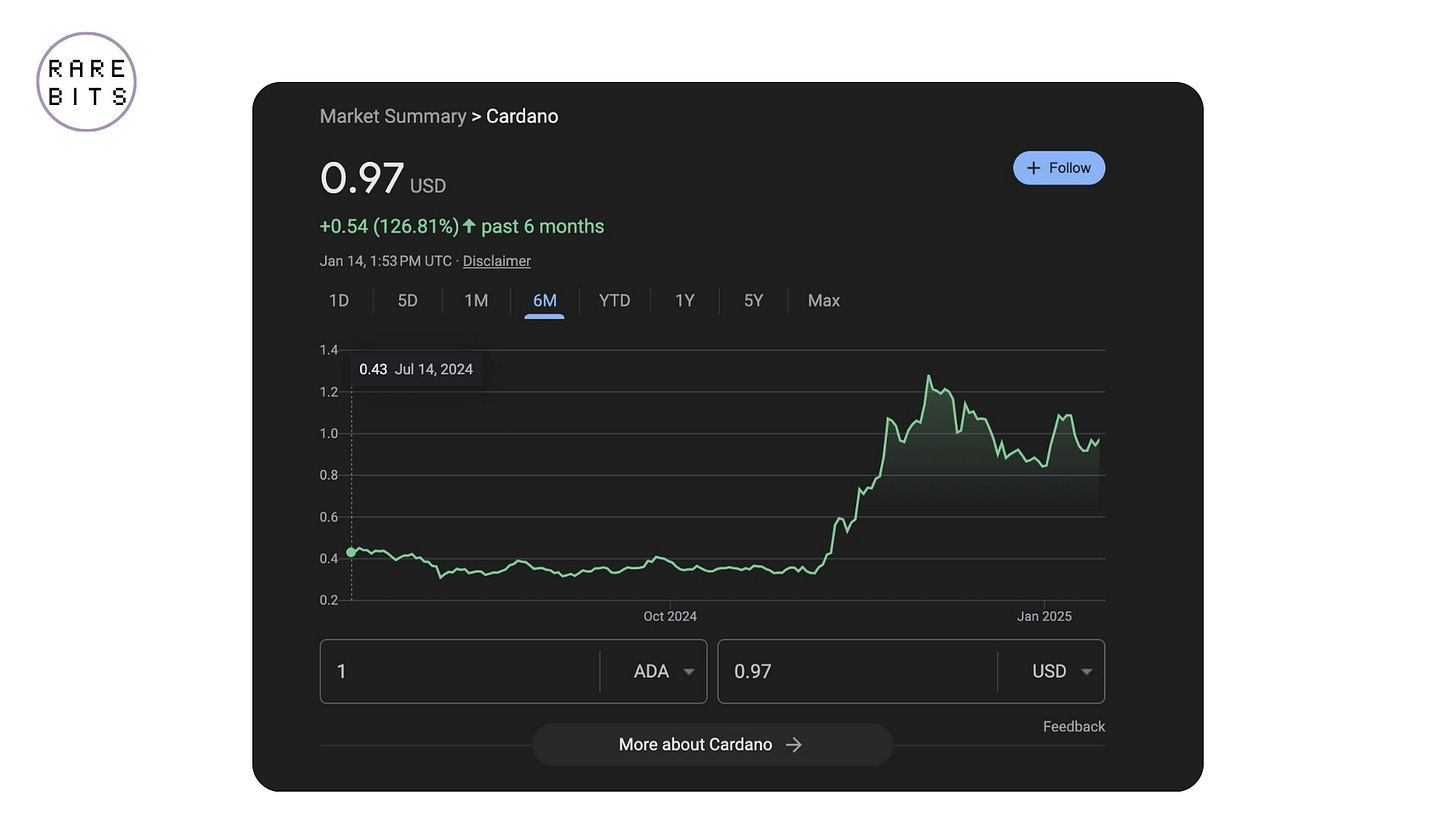

Cardano approaches $1 milestone amid volume surge

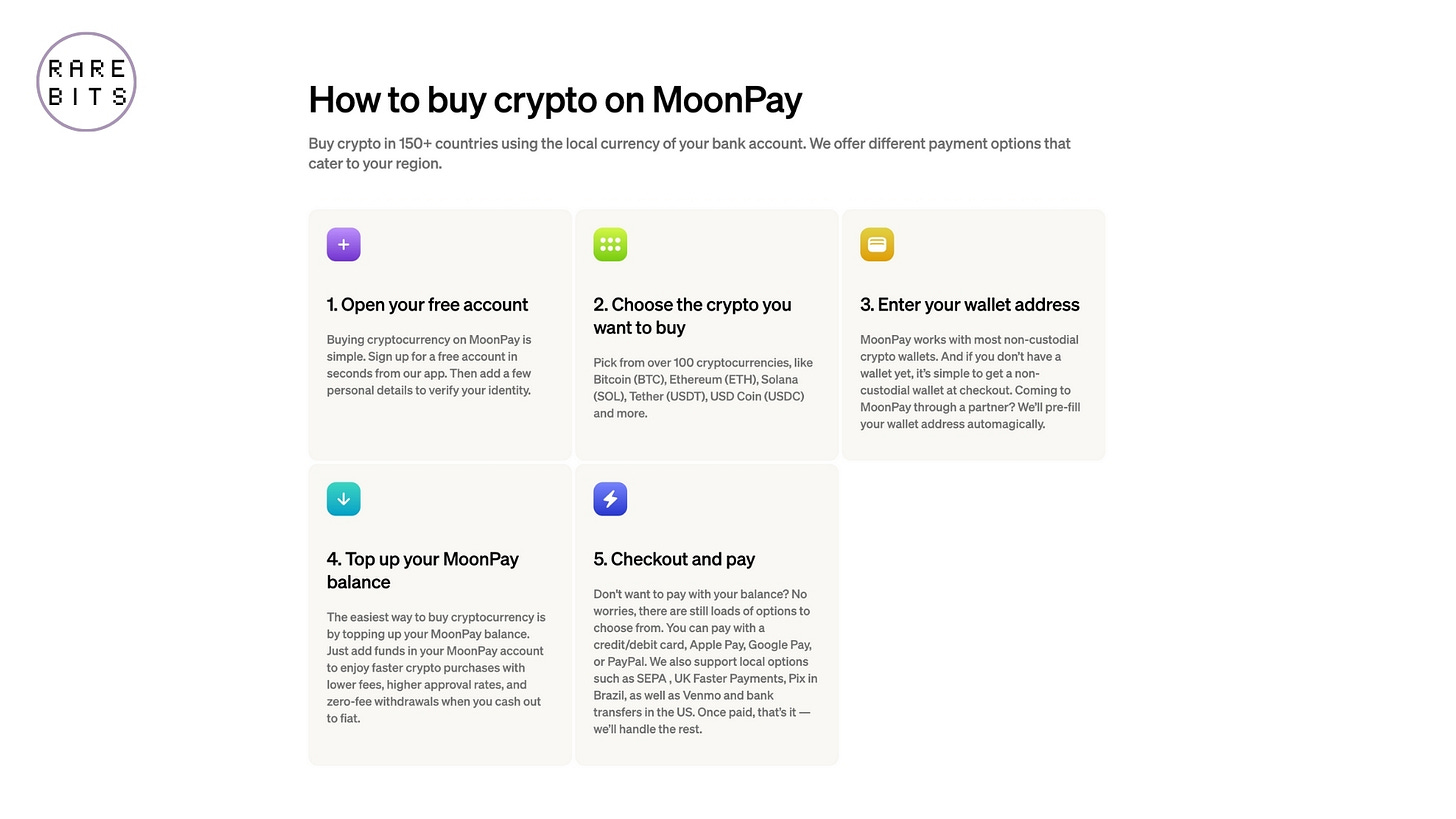

MoonPay acquires Helio in $175M equity deal

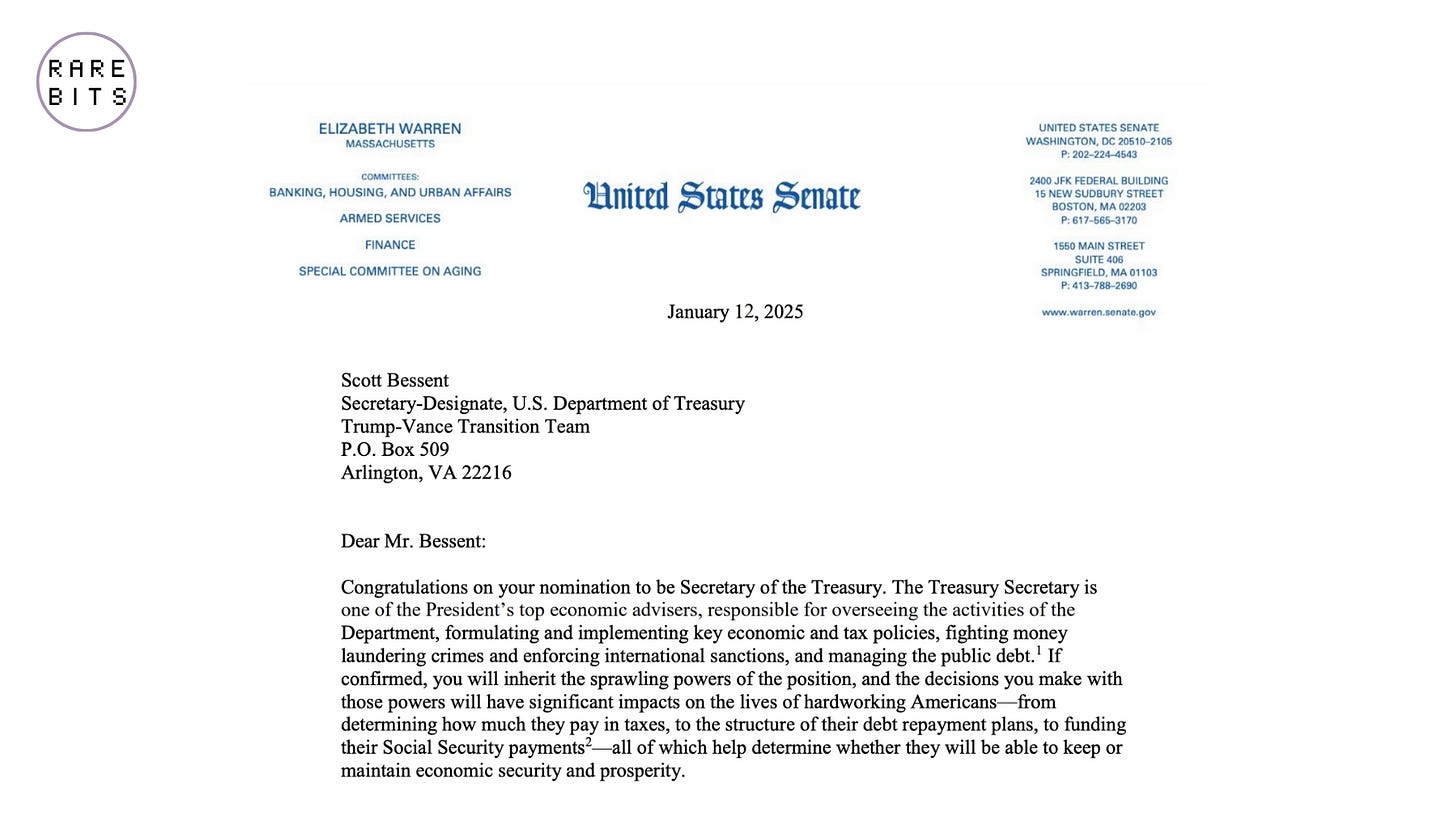

Warren scrutinizes Bessent's financial policy agenda

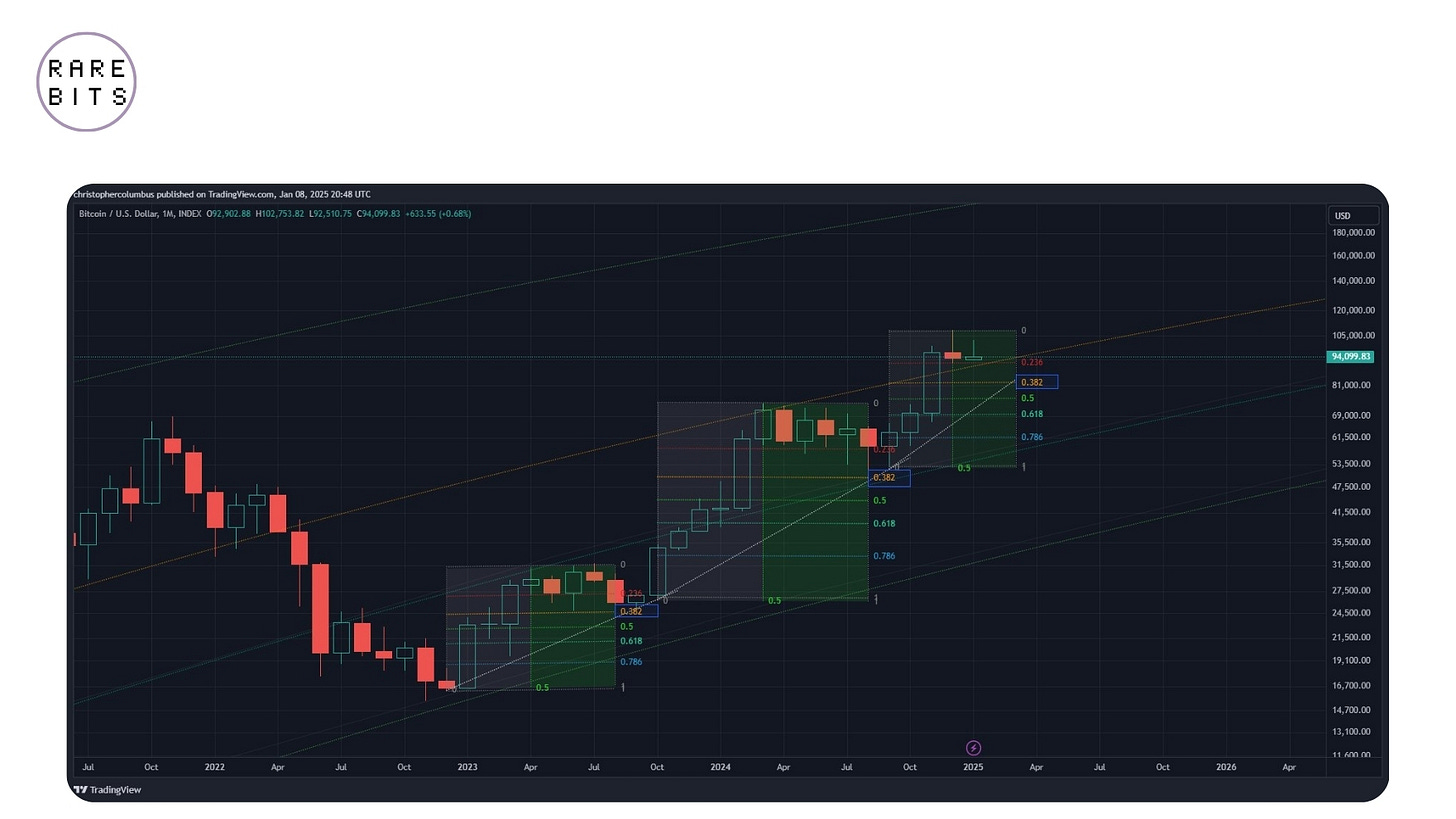

Bitcoin predicted to reach $180K after $82K dip

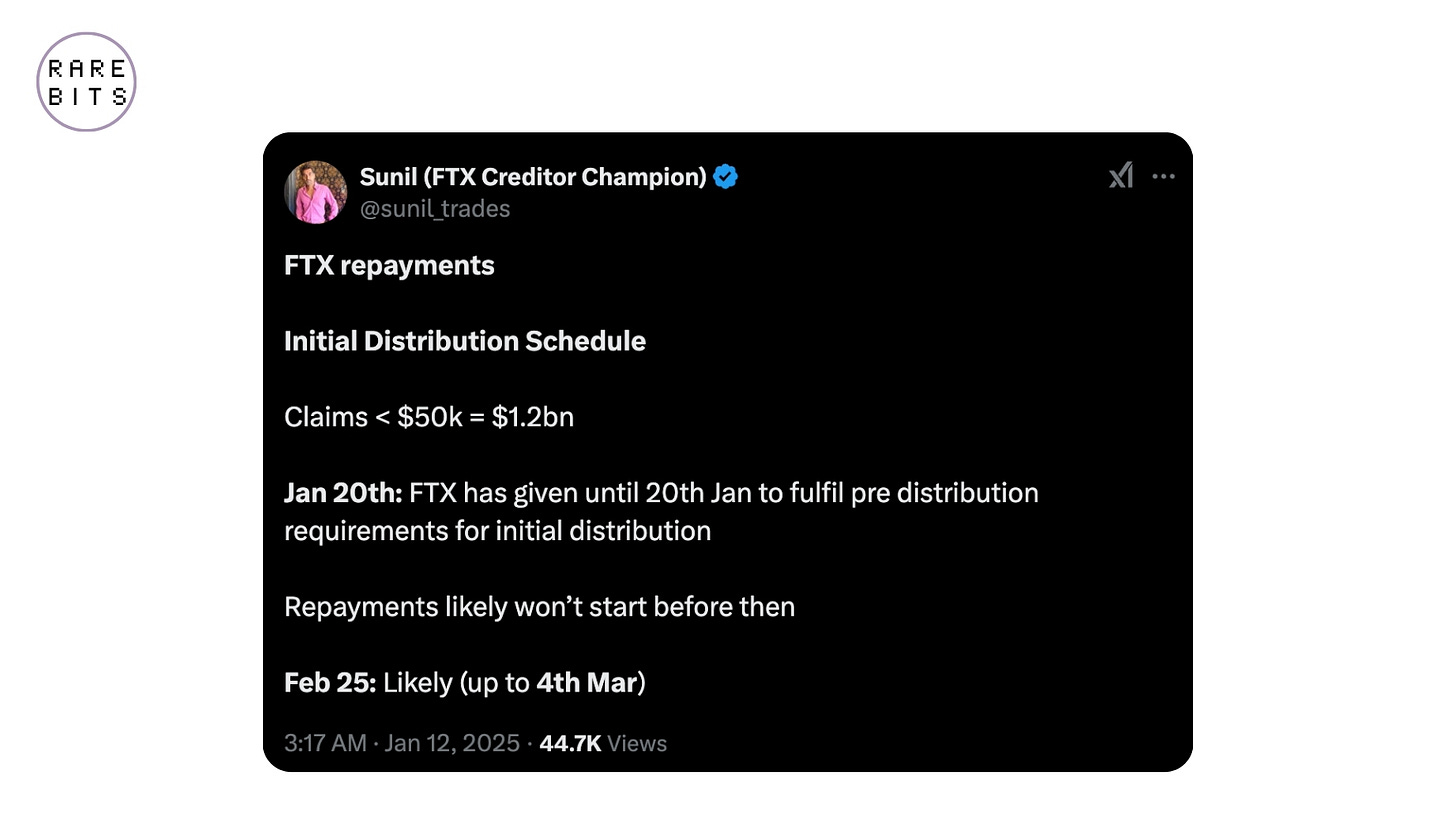

FTX preparing $1.2B user repayment plan

Sony launches Soneium L2 blockchain

TON blockchain targets U.S. expansion

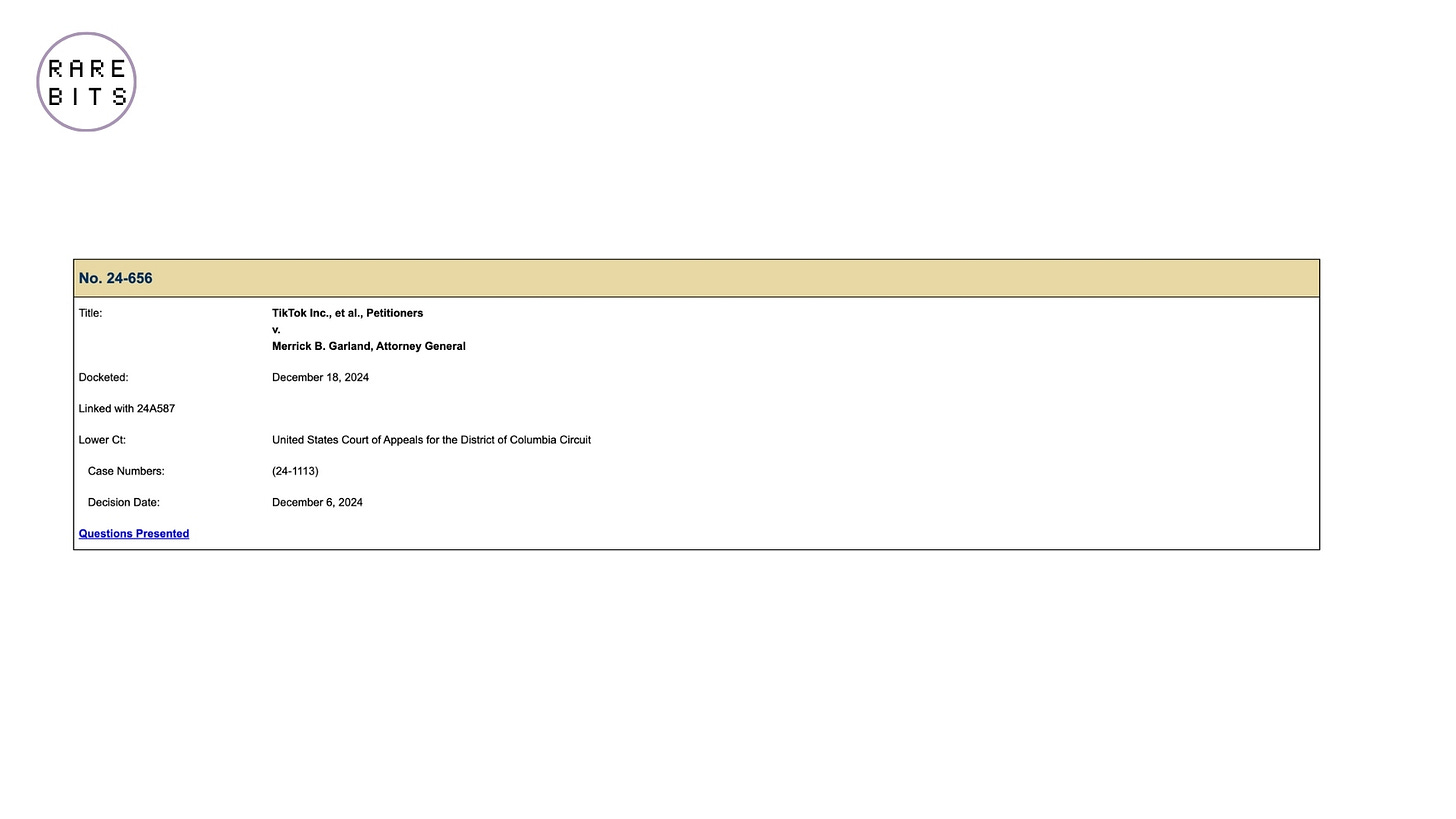

Supreme Court weighs TikTok ban decision

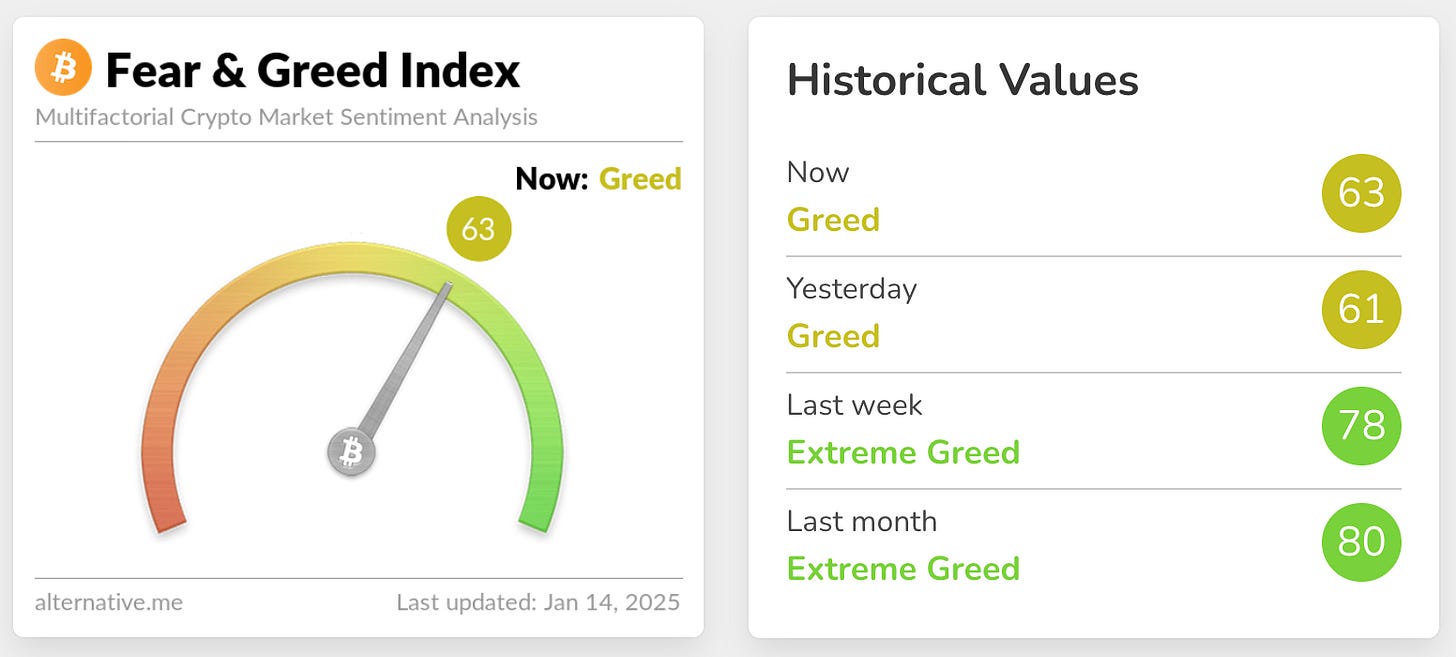

DOMINANCE & SENTIMENT

CRYPTO HEAT MAP

TOP COINS BY MARKET CAP

WTF NEWS

XRP is nearing a historic breakout against Bitcoin, recently surpassing critical resistance at 0.00002678 BTC after a 271% surge over two months. Analysts predict XRP could rally toward $4, with a long-term target of $8 if momentum persists. This resistance level has previously capped XRP's growth, making its potential breakout significant. The next critical zone lies near 0.00004239 BTC, a level not seen since 2019. However, failure to sustain the rally could invalidate these bullish projections.

Cardano (ADA) is approaching the $1 mark, driven by surging trading volume, increased investor interest, and ecosystem developments. ADA has rallied 8.2% to $0.9769, supported by a 59.85% trading volume increase to $1.47 billion. Correlation with Bitcoin’s bullish trend and discussions on integrating Ripple’s RLUSD into Cardano’s blockchain add to its growth potential. Analysts predict ADA could surpass $1 and target $1.15 if the community would stop calling Charles “Cattle Daddy”.

MoonPay has acquired Solana-based payments startup Helio in a $175 million all-equity deal, signaling its expansion into crypto payments infrastructure beyond on- and off-ramps. Helio's team, known for innovations like a Shopify plugin for Solana payments, will join MoonPay. This deal highlights increasing M&A activity in crypto payments, with notable parallels to Stripe’s $1.1 billion acquisition of Bridge. While some view MoonPay's move as internal consolidation, others see it as a step toward strengthening the underutilized crypto payments sector.

Senator Elizabeth Warren is scrutinizing Scott Bessent’s policy agenda, raising concerns about deregulation, tax policies, and financial transparency. She warns that past deregulation, such as before the 2008 crash and the 2023 Silicon Valley Bank collapse, highlights the risks of weakening oversight. Warren questions Bessent’s plans for regulatory agencies like the FDIC and CFPB, fearing they may empower big banks at the expense of everyday people. She also critiques extending tax cuts that favor the wealthy and questions tariff policies that could impact inflation and fairness. Transparency and conflict of interest remain key issues in her inquiries.

Dave the Wave predicts Bitcoin could drop to $82,000, touching the 0.382 Fibonacci retracement level, before rallying 119% to a peak of $180,000. He compares the potential pattern to Bitcoin’s movements in 2023-2024. Using his logarithmic growth curve (LGC) model, he anticipates a bull market top in mid-2025, aligning with historical peaks when Bitcoin’s one-year moving average reaches the LGC channel's midpoint.

The Flow Horse believes a broad altcoin season is unlikely due to limited market capital. He argues that while some assets may see significant pumps, it often comes at the expense of others, creating uneven market performance. With Bitcoin dominance rising to 58.53%, altcoins are underperforming as capital remains concentrated in BTC, leaving little for weaker assets with low interest or capital backing.

FTX is preparing to distribute $1.2 billion in repayments to users, with those owed up to $50,000 required to meet pre-distribution requirements by January 20, 2025. Payments are expected to start in February, with 98% of users reimbursed 119% of their claims based on cryptocurrency values at FTX’s 2022 bankruptcy. The repayments could significantly impact the crypto market, potentially boosting Bitcoin’s value. BitGo and Kraken will assist with the process. Meanwhile, FTX denies claims of FTX EU’s acquisition, and the US Justice Department seeks the return of $13.25 million in political contributions linked to former FTX executives.

Sony has launched its layer-2 blockchain, Soneium, built on Optimism's OP Stack to enhance Ethereum's scalability. Developed by Sony Block Solutions Labs in partnership with Startale Labs, Soneium aims to bridge web2 and web3 audiences by supporting gaming, finance, and entertainment apps. The platform emphasizes user-centric design to make blockchain interactions more accessible. Following a four-month test with 14 million wallets, Soneium joins other OP Stack-based networks like Coinbase’s Base and Kraken’s Ink, showcasing the growing interest of tech giants in blockchain technology.

The Telegram-linked TON blockchain project is shifting its focus to expanding in the U.S. under President-elect Donald Trump's administration. The TON Foundation plans to target the U.S. market as a key hub for crypto innovation, with newly appointed president Manuel Stotz leading the effort. Stotz, an investor in digital assets and founder of Kingsway Capital Partners, will replace Steve Yun, who remains on the board.

The U.S. Supreme Court is reviewing a case that could lead to TikTok’s ban over national security, data privacy, and misinformation concerns. A ruling is expected before January 19, 2025, when a law requiring TikTok’s Chinese parent company ByteDance to divest its U.S. operations takes effect. The U.S. government fears that ByteDance could use TikTok to gather sensitive data or influence public opinion. TikTok’s popularity among U.S. users, especially in the crypto space, has raised concerns about misleading content, with a significant portion of crypto advice on the platform being found to be deceptive. A ban could set a precedent for regulating foreign-owned tech platforms.

As we navigate through these transformative developments in the crypto landscape, the convergence of traditional institutions and blockchain innovation signals a maturing market. From Sony's strategic entry into the L2 space to FTX's commitment to making users whole, we're seeing a more sophisticated and accountable ecosystem emerge. The potential TikTok ban and regulatory scrutiny remind us that with great innovation comes great responsibility, but the future of digital finance remains bright with unprecedented institutional adoption and technological advancement. Stay interesting my friends.